This is Boondoggle, the newsletter about corporations ripping off our states and cities. If you’re not currently a subscriber, please click the green button below to sign up. Thanks!

The Government Accountability Office, the non-partisan agency that provides Congress with information about how taxpayer resources are being handled or mishandled, this week released a report on the Opportunity Zones tax break program. It shows that the program, created by the 2017 Trump tax cut law and touted incessantly by the outgoing president, has serious problems.

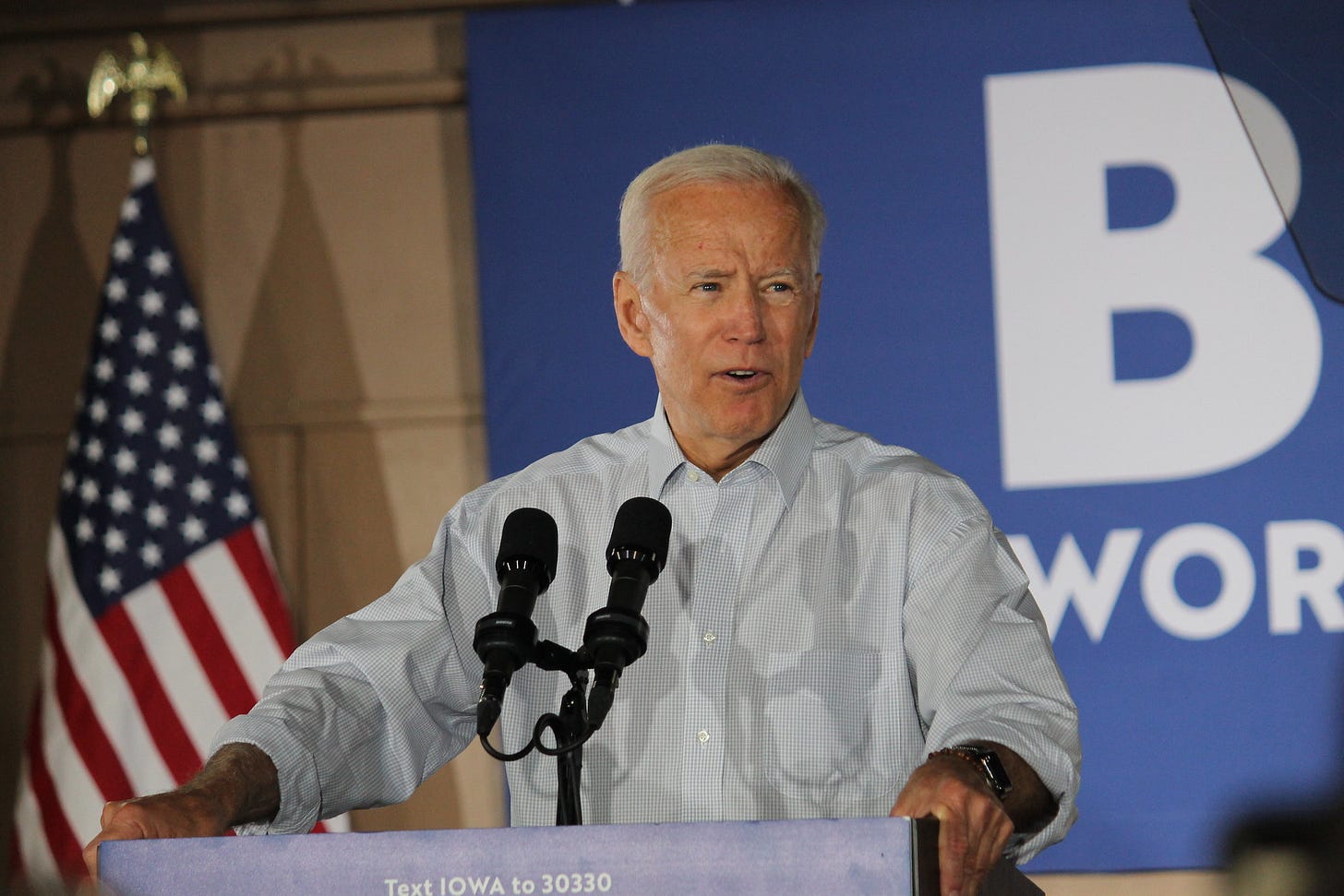

Fortunately, they are problems the incoming Biden administration can begin to address.

Opportunity Zones, often abbreviated to OZs, are supposed to draw new economic development into distressed neighborhoods by allowing investors to defer, and ultimately eliminate, their capital gains taxes on investments made in those neighborhoods.

That was the theory, anyway. What’s happening in practice is that investors are receiving tax breaks for projects they already started before the Opportunity Zone program even existed, for projects in already gentrified neighborhoods, or for luxury apartment buildings, sports stadiums, and super-yacht marinas that will in no way benefit poor communities.

Yes, you read that right. Super. Yacht. Marinas.

The hybrid nature of the program, in which governors nominated eligible tracts in their states to turn into OZs, which were then approved by the Treasury Department, lent itself to political favoritism, not-so-distressed neighborhoods slipping through the cracks, or gaming of the requirements regarding the economic identity of a eligible area.

For example, as Heather Gilligan reported in TalkPoverty, college towns qualify by having a high percentage of “low-income” people who are really just full-time students. Or high-income areas can qualify by virtue of being located next to even higher-income areas, as my former colleague Gbenga Ajilore explained.

So the foundation upon which the program is built was shaky from the start. (Which, to be fair, is more Congress’ fault that the Trump administration’s.) Several states — including Alabama, Arkansas, Connecticut, Louisiana, Maryland, Ohio, and Rhode Island —compounded the problem by layering their own state-level tax breaks on top of those already provided by the federal program.

And then we get to the tracking and data issues.

From the beginning, critics have alleged that the data collection and disclosure requirements for the program were so nonexistent that it would be hard to systematically deduce whether the people who were supposed to benefit from Opportunity Zones actually did.

That view was confirmed by the GAO, which wrote, “Without additional oversight, data collection and analysis, and reporting, policymakers and others will be limited in their ability to answer questions related to the performance of OZ in improving the economic well-being of people living in or served by these communities.”

So the federal government is losing revenue to a program that is going to assuredly boost the income of wealthy developers and investors, without any idea whether or not the communities designated as OZs receive any benefits, even though those downstream benefits are the program’s raison d’être. As is so often the case, OZ beneficiaries get to promise all sorts of stuff to local communities — and receive lucrative tax breaks for doing so — without anyone finding out if they actually followed through. It’s the neighborhood development version of trickle-down economics.

While I’d like to see this program tossed into the dustbin entirely, as Rep. Rashida Tlaib (D-MI) proposed last year, it’s unlikely Congress goes along with that, particularly if the Senate stays in Republican hands. The Treasury Department, though, has power to craft better regulations and to disclose much more publicly on the data collection side, should Biden tell it to.

Not that it received much in the way of campaign coverage, but repairing OZs was actually part of Biden’s economic platform, which included a pledge that OZ beneficiaries “provide detailed reporting and public disclosure on their Opportunity Zone investments and the impact on local residents, including poverty status, housing affordability, and job creation.”

Again, I’d rather throw Opportunity Zones out and start over with a program that doesn’t depend on tax giveaways to spark economic development, given the long history of that strategy being a complete and total failure. But Biden’s aims are a start toward making the program somewhat accountable to local concerns and not just another way for the government to hemorrhage revenue to rich folks for doing what rich folks do.

At the very least, Biden’s team can provide fuel to critics pushing for substantive legislative changes, for states to scrap their own OZ enhancements, or the program’s ultimate abolition. That’s something.

ONE MORE THING: In some more good news, Louisiana voters on Election Day voted down Amendment 5, which would have added a new way for Louisiana corporations to run off with taxpayer dollars, by a tally of 63 percent to 37 percent. The amendment lost in literally all of Louisiana's 64 parishes.

Thanks for reading this edition of Boondoggle. If you liked it, please take a moment to click the little heart under the headline or below. And forward it around to friends, family, or neighbors using the green buttons. Every click and share really helps.

If you don’t subscribe already and you’d like to sign up, just click below.

Finally, if you’d like to pick up a copy of my book, The Billionaire Boondoggle: How Our Politicians Let Corporations and Bigwigs Steal Our Money and Jobs, go here.

Thanks again!

— Pat Garofalo