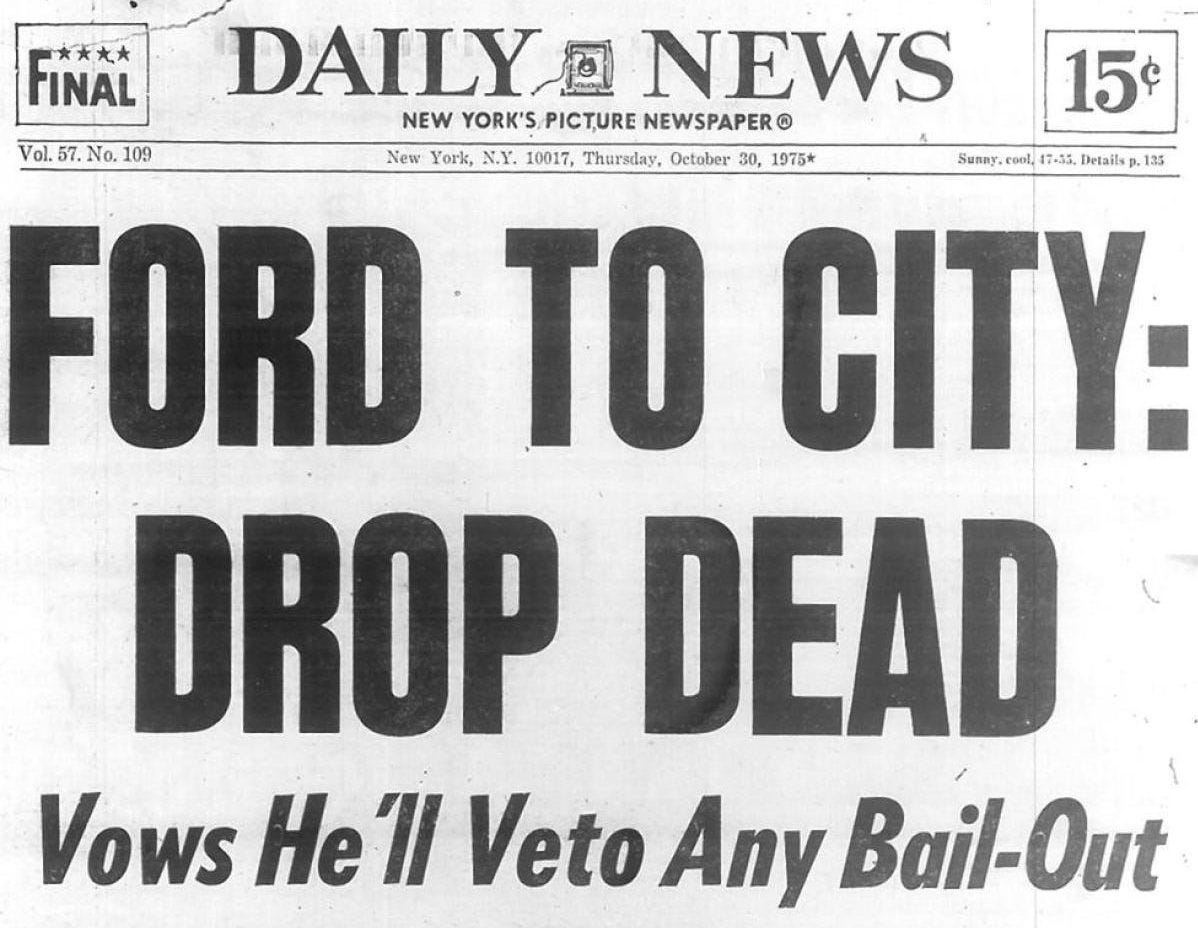

Federal Reserve to States and Cities: Drop Dead

The Fed went all out for big business. For states and cities, not so much.

If you’re a new reader and you’d like future editions of Boondoggle delivered via email, just click the green button below. Thanks!

Today I’m going to write about something a little different: Instead of explaining how a state or city is ripping off taxpayers, I’ll be looking at how states and cities have been left out to dry by the federal government during the pandemic, and especially by the Federal Reserve.

While the pandemic response adopted by Congress does include aid for states and cities to bolster their health care systems to deal with coronavirus patients, it’s patently clear more support is needed to prevent an economic catastrophe at the state and local level.

State and cities, remember, have to balance their budgets, and the combination of plummeting sales tax revenue due to coronavirus-related lockdowns, plummeting income tax revenue due to coronavirus-related joblessness, and, for many places, a complete vaporizing of any tourism revenue, means there are huge fiscal gaps to address.

According to the Economic Policy Institute, without further aid, 5.3 million state and local workers will lose their jobs by the end of next year. The National League of Cities reported this week that more than 700 cities have canceled or halted critical infrastructure projects because they’re no longer affordable. During the 2008 recession, job losses at the state and local level were a huge drag on the recovery, and the same thing is going to happen again this time absent intervention.

Congress is, at the moment, kinda sorta talking about another round of aid, but Senate Republicans seem in no hurry to produce anything, which is a real dereliction of duty.

Down the street at the Federal Reserve, meanwhile, there’s a program explicitly designed to help states and cities access funds: the Municipal Liquidity Facility. Great, you might say. The Fed can do what Congress won’t. But not so fast.

While the Federal Reserve’s programs to help big business have been super effective in letting them access money in a whole host of ways, the program to help states and cities has been used, per the latest report, exactly once, by the state of Illinois. No other state, city, or county has even bothered.

Why is that? As this report from the Center for Popular Democracy explains, the municipal lending program is designed to fail. It’s terms are so onerous and its eligibility requirements so ridiculous that only a few locales could feasibly benefit from it. In the whole country, only two states, three cities, and two counties would find the program useful.

The Fed is actually demanding higher prices for investment grade debt from states and cities — which is a pretty safe bet — than it is for some corporate debt that is rated as junk. In just one example, the city of Nashville found that it would cost more than $4 million more to borrow from the Fed than from private markets on a $200 million borrowing note.

That corporations are getting a better deal than the communities in which we all live isn’t some immutable fact that can’t be changed. It’s a policy choice. And smart folks have suggested fixes that would make the program much more useful for states and cities. The Fed just needs to make them — and it’s shown no hesitation to adjust programs on the fly.

And for those of you who may ask why the central bank should be providing cheap money to states and cities, remember that they had nothing to do with the coronavirus pandemic. In fact, they did the responsible thing — locking down economies — which caused all the fiscal problems they’re facing now. Providing low-cost funds to keep them afloat is the least the federal government can do.

Or, of course, Congress could also do the responsible thing and send funds to states and cities directly. But as things stand now, we’re in the worst of both worlds, with a legislative body unwilling to act and an unaccountable central bank being the only entity with the power to do something, but refusing to use it.

One more thing: In some good news, one of the California bills I wrote about a couple of weeks ago officially passed the state Senate.

Thanks for reading this edition of Boondoggle. If you liked it, please take a moment to click the little heart under the headline or below. And forward it around to friends, family, or neighbors using the green buttons. Every click and share really helps.

If you don’t subscribe already and you’d like to sign up, just click below.

Finally, if you’d like to pick up a copy of my book, The Billionaire Boondoggle, go here.

Thanks again!

— Pat Garofalo