One for All, and All Against Corporate Tax Breaks

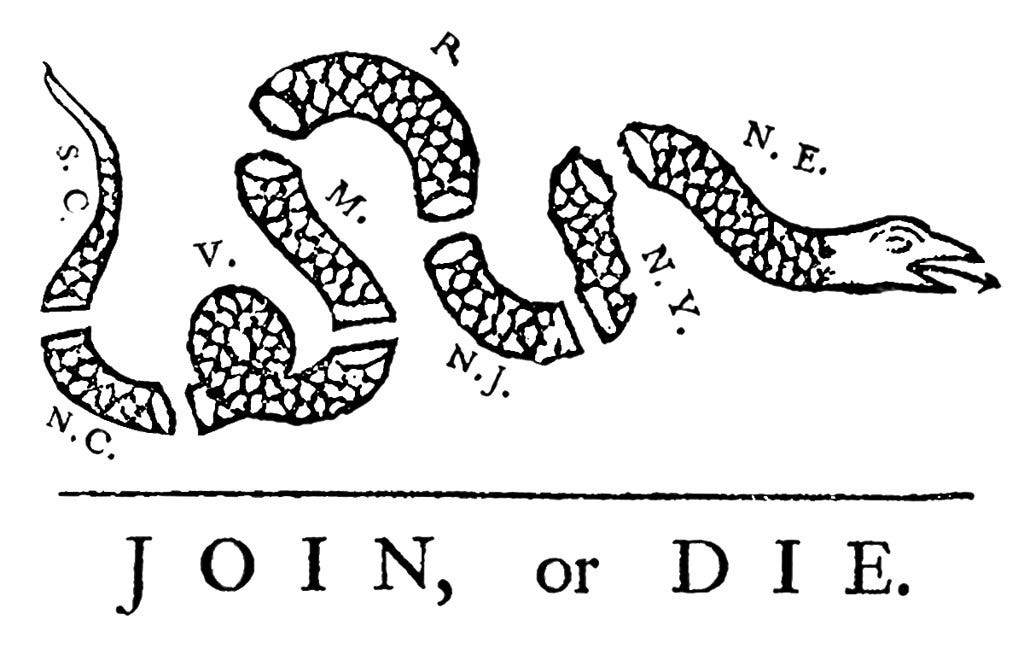

Lawmakers in more than a dozen states have introduced legislation to form a compact against corporate giveaways.

Hi everyone! I’m back from parental leave. Send me an email or leave a comment with any stories I might have missed that you think are worthy of attention.

On that note, something that got me excited while I was scrolling through Twitter in between diaper changes is that there’s now legislation in more than a dozen states — 13 as of this typing — that would create a national compact against state governments using tax incentives to steal jobs from one another.

Though the bills — introduced in Alabama, Arizona, Delaware, Florida, Hawaii, Illinois, Iowa, Maryland, New Hampshire, New York, Rhode Island, Utah, and West Virginia — differ in some specifics, the general thrust is that, once every state in the country gets on board, a compact would go into effect barring a state government or agency from using targeted tax breaks and incentives to lure a company located in another state.

“Unfortunately lawmakers across the country face a prisoners’ dilemma — we feel forced to participate in corporate tax giveaways because nearly everyone else does, and the only way to end this race to the bottom is an interstate agreement that phases us all away from this ineffective and wasteful game,” said State Rep. Anna Eskamani, D-FL, in an emailed statement.

The most absurd and well-documented example of state poaching used to occur in Kansas City between Missouri and Kansas. The two states only recently came to an agreement to knock it off, which means companies can no longer claim tax incentives for moving back and forth across the states’ respective borders.

An interstate compact would take that same idea, and make it national — no more riding into another jurisdiction, offering a company a bunch of money to move, stealing jobs from Peter to pay Paul and leaving everyone poorer in the long run.

"I’m deeply concerned about gross income inequality, and find myself often talking to people who are overly concerned about welfare for the poor. Welfare for the rich is far more prevalent, far more expensive, and incredibly unproductive,” State Rep. Josh Elliott, D-CT, who is introducing a bill to join the compact in the Nutmeg State, told me via email. “I have been looking for a way to combat this problem for a long time, and finally feel as though some progress is being made by working with this growing number of lawmakers on this interstate compact.”

Now, to be clear, there’s no chance of this compact coming into effect anytime soon. 13 states is not 50, and it won’t even pass in all 13. The compact also focuses on states poaching jobs from one another, which wouldn’t stop, say, Amazon, from auctioning off an entirely new headquarters, or a sports team from extorting a city for a new stadium, or a hotelier from threatening to keep lots vacant unless he receives a payout.

But the effort is still more than worthwhile. As I wrote in my book, one of the keys to stopped bad corporate tax incentive deals is publicizing them — telling people that they’re being sold out tends to gin up opposition. These bills help do that, in local papers and on local pols’ social media accounts and press releases, all of the places in which corporate interests ply their trade in order to rip off local governments. Talking about these bills can build awareness that states don’t have to keep the status quo in place, that a better deal for taxpayers is possible.

Work on a national compact could also lead to smaller, regional compacts. It would make sense, for instance, for New York, New Jersey, Delaware, Maryland, Rhode Island, and Connecticut to all get together and pledge not to poach companies from each other, long before a national effort is finalized. (To be fair, such regional efforts have had limited success in the past.) If lawmakers in a bunch of states are working on the issue, it’s less of a lift to get them all on the same page for a regional deal.

Sure, a national solution to states dishing out tax incentives is optimal. But states stepping in is the next best option, and these compact bills are movement in the right direction. I’ll be keeping an eye on the effort going forward, and will keep you all updated.

FYI: The NHL’s Carolina Hurricanes want an undetermined amount of public money in order to host a single game in an outdoor stadium, claiming that the contest will generate $22 million in economic impact for the Raleigh area. That’s, shall we say, wildly optimistic. This response I received on Twitter pretty much nailed it:

Thanks for reading this edition of Boondoggle. If you don’t subscribe already, just click the green button below.

If you liked this post, take a moment and click the little heart under the headline or below. It helps.

If you’re already a subscriber, please forward this around to friends, family, neighbors, or whoever you think might like it, and tell them to sign up too.

Finally, if you’d like to pick up a copy of my book, The Billionaire Boondoggle, go here. Thanks again!

— Pat Garofalo